-

May 1-5, 2023

MiDA Advisors is proud to lead the Prosper Africa U.S. Institutional Investor Delegation to Egypt

Prosper Africa will lead a high-level U.S. institutional investor delegation to Cairo, Egypt, from May 1 – 5, 2023, to attend the Africa Private Equity and Venture Capital Association (AVCA) Annual Conference and to explore investment opportunities and connect with top private equity and venture capital funds in Africa.

-

March 10, 2023

MiDA Advisors Partners with Prosper Africa to Announce Landmark USD $274 Million Financing for Affordable Housing in West Africa

MiDA Advisors joins the U.S. Government’s Prosper Africa initiative in announcing the successful raise of USD $274 million by Caisse Régionale de Refinancement Hypothécaire (CRRH) – a West African mortgage refinancing company headquartered in Togo. This innovative transaction marks a significant partnership with major U.S. financial institutions Bank of America Securities, Inc., Brean Capital, LLC, and The Bank of New York Mellon.

-

November 18, 2022

At its first anniversary, Asset Owners Forum South Africa exceeds infrastructure investment target, builds for the future

Johannesburg: In partnership with the U.S. Agency for International Development, MiDA Advisors, and the World Bank, the Batseta Council of Retirement Funds for South Africa (Batseta) commemorates the first anniversary of the Asset Owners Forum South Africa (AOFSA) today. Since its launch in November 2021, AOFSA has exceeded its fundraising target by nearly seven times.

-

November 14, 2022

MiDA Advisors Welcomes New Partner and Chief Operations Officer

MiDA Advisors is pleased to welcome Stéphane Le Bouder as Partner and Chief Operations Officer (COO). In his role as COO, Mr. Le Bouder will support the design, implementation, and execution of business strategies focused on expanding the business across new client relationships, business sectors, and regions.

-

September 19-20, 2022

African Women Impact Fund launches with USD$60 million commitment to drive an inclusive investment environment

Johannesburg / New York : The Economic Commission for Africa (ECA) and Standard Bank Group, with the support of the Arab Bank for Economic Development in Africa (BADEA), the Motor Industry Retirement Funds (MIRF) and Copartes Pension Fund and the African Union Commission (AUC), have announced the African Women Impact Fund (AWIF) Initiative’s achievement of its first commitment of USD$60 million. The announcement was made at the inaugural The Global Africa Business Initiative, held from 18 – 19 September during the week of the United Nations General Assembly in New York City.

-

January 0, 0000

AIH Capital- A 100% Black Women-Owned and Operated South African Private Equity Fund Secures $25 Million USD Investments

With a flourishing middle class and its spending power growing at exponential rates, opportunities for investors to impact change in African communities are burgeoning. Impactful investing in Black women-owned businesses is especially important because these businesses, time and time again, invest their earnings back into their families and communities, raising the tide for all. AIH Capital’s managing partners, Jesmane Boggenpoel and Sindi Mabaso-Koyana, are the driving force behind the efforts that secured $25 million USD (R400M) as a 100% Black women owned and managed fund manager.

-

January 0, 0000

Financing The Development of Critical Infrastructure in Kenya with Local Institutional Capital

Kenya Pension Fund Investment Consortium into the Lot 3 Road Project Bonds through USAID, the World Bank, and MiDA Advisors Support

-

January 0, 0000

Supporting Small and Mid-Sized Enterprises (SMES) and Consumer Finance Markets in Francophone West Africa

MiDA Advisors, with the support of the United States Agency for International Development (USAID), mobilized U.S and African Institutional Investors to co-invest in an Africa focused fund – ADP III managed by Development Partners International (“DPI”). In 2021, DPI, a premier investment firm focused on Africa with $2.8 billion in assets under management including co-investments of $85 million from the City of Philadelphia Board of Pensions and Retirement, Chicago Teachers’ Pension Fund, KenGen Pension Scheme, Banki Kuu Pension Scheme, and Eskom Pension and Provident Fund, into its ADP III Fund.

-

August 2-8, 2022

USAID Supports 5 Investor Delegation Trip To South Africa

From August 2-8, 2022, the fifth U.S. Institutional Investor Delegation trip to Africa will take place with a focus on South Africa. These delegations are part of an ongoing U.S. Government effort to support relationship building and co-investment among U.S. and African partners. This delegation will strengthen relationships among Africa-focused fund managers and highlight opportunities for co-investing with the Asset Owners Forum South Africa. The delegation will include some of the largest U.S. pension funds and foundations exploring opportunities in Southern Africa, including the Oakland Police and Fire Retirement System, Kansas City Public School Retirement System, and New York City Employees’ Retirement System.

-

August 2-8, 2022

USAID Supports 5th Institutional Investor Delegation Trip To South Africa

USAID will bring 20 U.S. investors and asset managers to South Africa from August 2-8, 2022, to strengthen relationships and highlight investment opportunities. From August 2-8, 2022, the fifth U.S. Institutional Investor Delegation trip to Africa will take place with a focus on South Africa. These delegations are part of an ongoing U.S. Government effort to support relationship building and co-investment among U.S. and African partners. This delegation will strengthen relationships among Africa-focused fund managers and highlight opportunities for co-investing with the Asset Owners Forum South Africa.

-

January 0, 0000

How the U.S. plans to make Africa a big investment destination

CNBC Africa spoke to Cameron Khosrowshahi, Senior Investment Advisor, Prosper Africa and Daniel Miller, Deputy Executive Director, NYC Board of Education Retirement Systems about enriching cross-continental collaboration between the U.S. and Africa.

-

Impact Alpha | March 8, 2022

Seizing Africa’s overlooked investment opportunities with an inclusivity lens

As women asset managers in Southern Africa, we see a growing, young, ambitious population that wants to do better for themselves and their countries. We see the person in a shanty town (one of South Africa’s slums) aspiring to live in a formal house and own a car. We see more and more of the black community beginning to lead the emerging middle class. We see that when you invest in women—from street vendors to business executives—they turn around and invest back into their families and communities. And we see how we shoot ourselves in the foot when we ignore large segments of society, allowing that potential to go untapped and ignored. We see these things because we are all too familiar with being overlooked. As owners of two of the too few black women-owned and -led private equity firms in South Africa—and across the globe—we see and experience a lot that others don’t.

-

next billion | February 18, 2022

Changing the Gatekeepers: Why Female Fund Managers Are the Key to Unlocking More Inclusive Capital

The doors to financial empowerment and inclusion are typically shut to women entrepreneurs. Greater access to capital could help us unlock them, yet women comprise a small portion of fund managers in the private equity sector – the people who serve as gatekeepers to capital for small and medium-sized enterprises (SMEs). The International Finance Corporation found that only 11% of senior investment professionals in emerging markets are women. And the situation is no better in developed markets, where only 10% of these professionals are women. Unfortunately, the statistics for female representation among fund managers are not improving. But other statistics offer more reason for hope: Female funders are twice as likely to invest in startups with at least one female founder and three times as likely to invest in female CEOs. (Goldman Sachs also found that female-managed funds typically outperform their male-managed counterparts.)

-

January 0, 0000

This Bond Could Be a Breakthrough in Combatting West Africa’s Housing Shortage

For most West Africans, homeownership is out of reach. Rapid population growth and urbanization have created a housing shortage, exacerbated by the lack of access to affordable mortgage loans to finance purchases. With support from USAID INVEST, the Caisse Regionale de Refinancement Hypothecaire (CRRH) is bringing a new investment opportunity to U.S. markets that offers investors attractive financial and social returns — and West Africans the resources to make homeownership a reality.

-

Africa investor | October 27, 2021

MiDA Advisors, Standard Bank and Mercer Launch Infrastructure Publication Part II in Effort to Mobilise Private Capital for African Investment and Development

MiDA Advisors and Standard Bank Group, in collaboration with Mercer, have published the second edition of the report titled “Infrastructure financing in sub-Saharan Africa: Opportunities and impact for institutional investors”, to present the attractive case for investing in Africa. This report builds upon the 2018 groundbreaking publication by MiDA Advisors and Mercer, Investment in African Infrastructure: Challenges and Opportunities, which offered an initial examination of sustainable investment opportunities in sub-Saharan Africa.

-

USAID | October 19, 2021

Through Prosper Africa, USAID Drives Investment In Affordable Housing Across West Africa

Today Dana Banks, Special Assistant to the President and Senior Director for Africa for the White House National Security Council, announced a pioneering investment at the Financial Times Africa Summit. Caisse Régionale de Refinancement Hypothécaire (CRRH) – a West African mortgage refinancing company headquartered in Togo – is using Prosper Africa support to help raise more than $300 million to expand financing for West Africa’s homeowners. This investment will mobilize private capital into West Africa’s housing sector, significantly increasing access to affordable housing across the region—a critical intervention amidst COVID-19.

-

MiDA Advisors | October 12, 2021

MiDA Advisors Announces Allocations to African Private Equity and Infrastructure by U.S., Kenyan, and South African Pension Funds Under Initiative Funded by the U.S. Agency For International Development (USAID)

MiDA Advisors is pleased to announce new investments by U.S. and African pension funds into two Africa-focused funds; African Development Partners III (ADP III) advised by Development Partners International (DPI), and Everstrong Kenya Infrastructure Fund (EKIF) managed by Everstrong Capital. These allocations were enabled by USAID-supported investor mobilization, education, market research, and direct exposure and access to investment opportunities in Kenya, South Africa and across the African continent.

-

USAID INVEST | August 2021

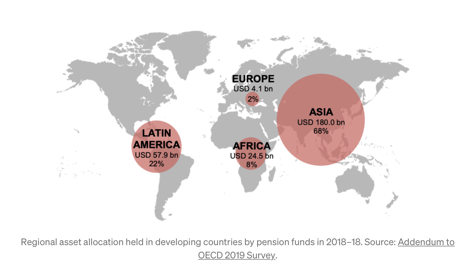

Pension Funds Could Close the SDG Gap. What’s Holding Them Back?

Pension funds and other institutional investors hold more than $100 trillion in assets, and their stakeholders are increasingly interested in utilizing those funds to make socially responsible investments. At the same time, countries in Africa are growing fast — but risk falling behind if they can’t finance the necessary infrastructure to support their growth. On the surface, it would seem like a perfect union of returns and social responsibility. Yet only a fraction of institutional investors hold assets in developing countries. What is holding them back? And how can donors like USAID help?

-

Prosper Africa | August 2021

Why Investing in Emerging Markets is a Win for Investors and African Companies

CEO of Development Partners International (DPI) Runa Alam talks about the history of Pan-African private equity, the potential for institutional capital to drive the continent’s development, and the role of the Prosper Africa initiative in catalyzing two-way trade and investment between the United States and African nations.

-

Global Impact Investing Network | July 13, 2021

Institutional Asset Owners: Approaches to setting social and environmental goals

Institutional asset owners are increasingly interested in incorporating social and environmental factors into their portfolios and investments strategies. The pandemic, the climate crisis, and other social and environmental challenges have all signaled a fundamental need for change – to allocate more capital into investment products that incorporate some consideration for the real-world outcomes that the investments generate.

-

Prosper Africa | June 2021

Institutional Investor Highlights Opportunities in Africa—an Interview with Aymeric Saha

With a little more than $2 million in grant funding, the USAID’s MiDA Program mobilized $1 billion in two-way investment commitments between the U.S. and Africa

-

Joseph Boateng | June 2021

Consider yourself a fiduciary? Then it’s time to invest in Africa

Africa was home to half of the world’s 10 fastest growing economies last year. Institutional investors must begin to seriously consider Africa as an investment destination.

-

Anna Lyudvig | June 2021

Building relationships with asset managers

AGF’s Anna Lyudvig speaks with Angela Miller-May about investments opportunities in Africa and private equity.

-

DFC | June 2021

G7 Development Finance Institutions and Multilateral Partners to Invest Over $80 Billion into African Businesses Over the Next Five Years

WASHINGTON – The G7 DFIs, the IFC, the private sector arm of the African Development Bank, EBRD, and the EIB today announced that they were committed to investing $80 billion in the private sector over the next five years to support sustainable economic recovery and growth in Africa.

-

MiDA Advisors and SAVCA | April 2021

Inaugural Women Empowerment Mentoring and Incubation (WE > MI) Fund Manager Programme Launches to Increase the Number of Women-Owned and Managed Funds in Southern Africa

To increase the number of investable women fund managers in Southern Africa, MiDA Advisors, a global transaction and financial advisory firm, and SAVCA are launching the Women Empowerment Mentoring and Incubation Fund Manager Programme (WE>MI) supported by the United States Agency for International Development (USAID).

-

Jacqueline Irving, IFC | April 2021

How the COVID-19 crisis is impacting African pension fund approaches to portfolio management

Ahead of the onset of the COVID-19 crisis, local pension sectors had been growing rapidly across the African region since the late 2000s. Further development and appropriate regulation of local pension funds and other institutional investors with longer-term investment horizons could enable these financial institutions to become important sources of local finance for infrastructure and other longer-term socioeconomic development needs.

-

USAID INVEST | August 2020

Voices from the USAID Finance and Investment Network: MiDA Advisors

MiDA Advisors, a U.S.-based investment advisory firm, works with USAID INVEST to increase U.S. institutional investments in African infrastructure and markets. MiDA Advisors CEO Aymeric Saha discusses the firm’s mission, explains why private sector engagement matters for development outcomes, and offers advice for other firms seeking to work with USAID.

-

USAID-INVEST | April 2020

Overcoming an Outdated Narrative: Why Investors Need to Recognize Africa’s True Potential

It’s a pervasive narrative, upheld through modern media and internalized by Western audiences. It’s also an incomplete story—a one-dimensional frame that’s had an extraordinary influence on how much of the world views Africa. This worldview permeates even the financial sector, causing investors to overemphasize risks—both real and imagined—across the continent. As a result, they overlook investment opportunities that could benefit their shareholders and retirees, as well as enhance America’s contribution to the prosperity, stability and self-reliance of African nations.

-

Ventures Africa, April 2020

Brand Finance Ranks MTN, ETISALAT Top Telecom Brands in Africa

Johannesburg-headquartered MTN Group is the most valuable and strongest telecom brand in Africa, a report released this week by Brand Finance shows, while ranking Etisalat top in the Middle East and Africa region as a whole.

-

European Commission, March 2020

EU paves the way for a stronger, more ambitious partnership with Africa

The European Commission and the High Representative for Foreign Affairs and Security Policy today proposed the basis for a new strategy with Africa. The communication sets out proposals to intensify cooperation through partnerships in five key areas: green transition; digital transformation; sustainable growth and jobs; peace and governance; and migration and mobility.